IRS 940 - Schedule R 2024-2025 free printable template

Show details

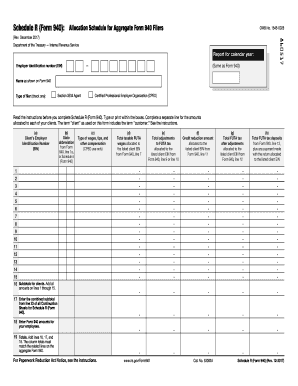

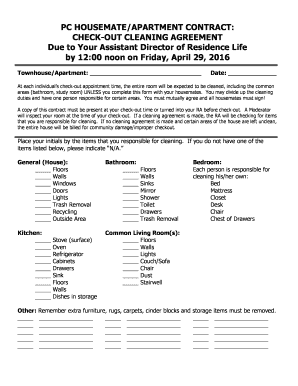

For Paperwork Reduction Act Notice see the instructions. www.irs.gov/Form940 Cat. No. 53082A Page of Continuation Sheet for Schedule R Form 940 1 through 22. Schedule R Form 940 Allocation Schedule for Aggregate Form 940 Filers OMB No. 1545-0029 860517 Rev. December 2024 Department of the Treasury Internal Revenue Service Report for calendar year Employer identification number EIN Same as Form 940 Name as shown on Form 940 Type of filer check one Section 3504 Agent Certified Professional...

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS 940 - Schedule R

Comprehensive Steps for Modification

Guidelines for Filling Out the Form

Understanding and Utilizing IRS 940 - Schedule R

IRS 940 - Schedule R is a vital document for employers who need to report and reconcile their FUTA (Federal Unemployment Tax Act) tax liabilities. Properly using this form ensures compliance with federal tax regulations and can help avoid penalties. This guide will walk you through the intricacies of IRS 940 - Schedule R, providing detailed instructions and insights for effective tax management.

Comprehensive Steps for Modification

01

Review your current IRS 940 - Schedule R for accuracy.

02

Identify any changes to your business operations that may affect your FUTA liabilities.

03

Consult the IRS instructions for the latest modifications to the form or regulations.

04

Proceed to amend the details as necessary, ensuring all figures align with your payroll records.

05

Secure the form and prepare for submission by checking the required signatures and dates.

Guidelines for Filling Out the Form

01

Gather all payroll records and previously filed forms to ensure accuracy.

02

Navigate to Section A to report your adjusted FUTA tax liability.

03

In Section B, detail the number of employees and wages to determine applicable tax rates.

04

Complete Section C if you have any state credit reductions.

05

Double-check all entries before submission to prevent errors.

Show more

Show less

Latest Modifications Relating to IRS 940 - Schedule R

Latest Modifications Relating to IRS 940 - Schedule R

Recent updates to IRS 940 - Schedule R may impact how employers report their FUTA taxes. Notably, the thresholds for credit reductions and specific reporting criteria have been adjusted. Be sure to review the IRS website or consult with a tax professional for the most current requirements and changes to the filing process.

Essential Insights into IRS 940 - Schedule R

Defining IRS 940 - Schedule R

Purpose of IRS 940 - Schedule R

Eligible Filers for this Form

Eligibility for Exemptions

Understanding when the Exemption Applies

Key Components of IRS 940 - Schedule R

Filing Deadline for IRS 940 - Schedule R

Comparative Analysis of IRS 940 - Schedule R with Other Forms

Transactions Covered by IRS 940 - Schedule R

Submission Requirements for Copies of the Form

Penalties for Non-compliance with IRS 940 - Schedule R

Required Information for Filing IRS 940 - Schedule R

Additional Documentation to Accompany IRS 940 - Schedule R

Address for Submitting IRS 940 - Schedule R

Essential Insights into IRS 940 - Schedule R

Defining IRS 940 - Schedule R

IRS 940 - Schedule R is a supplemental form used by employers who are subject to the Federal Unemployment Tax Act (FUTA). It allows employers to report any adjustments to their FUTA tax liabilities based on wage payments to employees.

Purpose of IRS 940 - Schedule R

The key purpose of this form is to reconcile the employer’s FUTA taxes, including any credits for state unemployment taxes paid. This document is essential for accurately reporting employment tax obligations and determining any required payments to the IRS.

Eligible Filers for this Form

Employers who paid wages to employees and are subject to FUTA tax must complete IRS 940 - Schedule R. This includes businesses of all sizes, including sole proprietorships, partnerships, and corporations.

Eligibility for Exemptions

Several conditions may qualify employers for exemptions from filing IRS 940 - Schedule R. Consider the following:

01

Employers with fewer than four employees during any quarter of the calendar year.

02

Entities earning below a specified income threshold based on specific industry standards.

03

Certain nonprofit organizations or governmental units as defined by the IRS.

Understanding when the Exemption Applies

The exemption is typically applicable for employers who do not meet the minimum wage thresholds or who have had minimal employee turnover. It's crucial to assess quarterly employment records for any potential exemptions based on staffing levels.

Key Components of IRS 940 - Schedule R

IRS 940 - Schedule R comprises several important sections, including:

01

Adjustment of FUTA tax liability.

02

Number of employees for the taxable year.

03

State unemployment tax credits.

04

Detailed wage payments report for the year.

Filing Deadline for IRS 940 - Schedule R

The filing deadline for IRS 940 - Schedule R typically falls on January 31 of the following year. Employers should file by this date to avoid late fees or penalties associated with non-compliance.

Comparative Analysis of IRS 940 - Schedule R with Other Forms

In comparison to similar forms such as IRS Form 941 (Employer's Quarterly Federal Tax Return), IRS 940 - Schedule R is specific to unemployment tax liabilities, focusing solely on FUTA rather than all employment taxes. This distinction is crucial for employers managing their tax responsibilities.

Transactions Covered by IRS 940 - Schedule R

IRS 940 - Schedule R reports transactions related exclusively to unemployment compensation. It does not cover other employment taxes, making it a specialized form aimed at FUTA obligations.

Submission Requirements for Copies of the Form

Employers are generally required to submit one copy of IRS 940 - Schedule R. However, they should retain copies for their records, as well as provide necessary forms to state agencies if mandated.

Penalties for Non-compliance with IRS 940 - Schedule R

Failure to submit IRS 940 - Schedule R can incur serious penalties, which may include:

01

Late filing penalties starting at 5% of tax due per month, capped at 25%.

02

Failure to pay penalties, accruing interest on the unpaid amount.

03

Legal consequences, including fines or audits, which could escalate depending on the severity of non-compliance.

Required Information for Filing IRS 940 - Schedule R

To file IRS 940 - Schedule R, employers must provide detailed information such as:

01

The total amount of FUTA tax owed.

02

Number of employees and total wages they paid over the year.

03

Any adjustments related to state taxes that affect the FUTA liability.

Additional Documentation to Accompany IRS 940 - Schedule R

Employers may need to include related forms such as state unemployment tax returns or any amendments to previous filings depending on their specific circumstances.

Address for Submitting IRS 940 - Schedule R

IRS 940 - Schedule R should be mailed to the address specified in the IRS instructions corresponding to the state of the employer’s principal business location. Make sure to verify the submission address before mailing your return.

By understanding the complexities and requirements of IRS 940 - Schedule R, employers can better manage their tax liabilities and ensure full compliance with federal regulations. For further assistance or to begin your tax preparation process, consider reaching out to your tax professional or use resources like pdfFiller for efficient document management.

Show more

Show less

Try Risk Free